P2P loans are just another option. The process is also easy — you can do everything online which is also true for many banks these days, but some still require paperwork. As a wise consumer, you should check out all of the options and go with froj best one. Be sure to include local credit unions in your search, and other non-bank online lenders. Car Loans Student Loans. The Balance Loans. By Cna Pritchard. Assuming you qualify to borrow, your loan may be funded within a few days.

Is a guarantor loan a better option to loaning money to a friend?

LendingClub has become one of the more reputable destinations for online personal loans, usually an ideal method to borrow for a special need or credit card debt consolidation. It helped to originate peer-to-peer marketplace lending, which matches borrowers with investors who are willing to fund the loans. LendingClub is best suited to serve borrowers with responsible payment records and established financial histories. The typical LendingClub client has a good credit score and a lengthy credit history an average of 17 years. The purpose of these loans has been refinancing a home The risk: Investors — not LendingClub — make the final decision whether or not to lend the money. That decision is based on the LendingClub grade, utilizing credit and income data, assigned to every approved borrower. That data, known only to the investors, also helps determine the range of interest rates offered to the borrower. Once approved, your loan amount will arrive at your bank account in about one week. Borrowers can file a joint application, which could lead to a larger loan line because of multiple incomes. That would bring a high interest rate and steep origination fee, meaning you could probably do better with a different type of loan. It will allow you to conveniently shop around without hurting your credit score. Of course, the interest rate might not be ideal with that score, but it might be a good deal for borrowers with so-so credit who usually have to settle for subprime offers.

I will guard your email with my life.

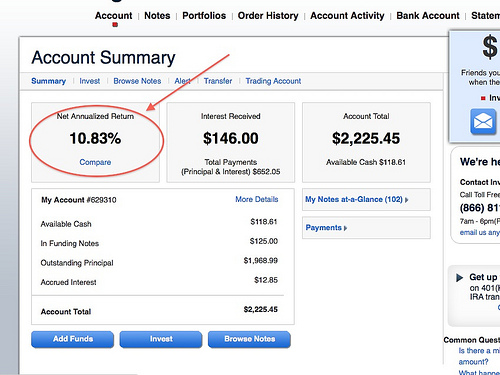

Adventurous readers may recall that we are in the middle of a Lending Club Experiment — on September 24th, I posted an article describing my first foray into peer-to-peer lending and promised to keep you updated on the progress of the investment. For the past four months I have monitored the account, manually reinvesting the principal and interest payments from borrowers and mentally salivating over the high returns. I continued to study the Lending Club business model and read other blogs which experiment with peer-to-peer lending. Meanwhile, in mid-November I exchanged a few emails with Lending Club representatives. From the conversations, I learned a few things:.

Lending Club Review: For Investors

If you open an account through one of these links the blog will receive a small commission from Lending Club. This review was last updated in June, Why have they been so successful? They provide excellent returns for investors and they allow quick access to funds at competitive interest rates for borrowers. Some investors read about Lending Club and dive right in. But the intelligent investor does some research. This article will provide all the information a new investor needs to get started. To help you get familiar with the Lending Club platform I have recorded a short video. This video provides an introduction to the Lending Club interface and shows you how to invest in these p2p loans. Before you begin, though, you need to consider if you are eligible to invest. To invest at Lending Club you need to meet a number of requirements:. Every investor should consider the risks of an investment before committing their money. Investing with p2p lending has a number of risks:. Peer to peer lending at Lending Club is a very simple process. It begins with the borrower. Investors can browse the loans on the platform and build a portfolio of loans. Each portion of a loan is called a note and smart investors build a portfolio of notes to spread their risk among many borrowers. Lending Club will perform some level of verification on every borrower.

If you enjoyed this article, subscribe to updates:

P2P loans are just another option. The process is also easy — you can do everything online which is also true for many banks these days, but some still require paperwork. As a wise consumer, you should check out all of the options and go with the best one. Be sure to include local credit unions in your search, and other non-bank online lenders. Car Loans Student Loans.

The Balance Loans. By Justin Pritchard. Assuming you qualify to borrow, your loan may be funded within a few days. In rare cases, it takes up to two weeks for investors to fund your loan. Types of loans: loans monye be used for just about. Business loans are available, but not for startups. Your business must have been in operation for at least two years. If you get a personal loanyou can use the funds for anything you want — including your small business, healthcare, home improvements, and.

Eligibility: to get a loan, you must be at least 18 years old and a U. Lending Club will also check your credit scores. Loans come in three and five-year termsbut you can pay makr your debt early without any prepayment penalty. Credit reporting: your loans and payments are reported to credit bureaus. These loans can help you build credit if you make your payments every month, making it easier to get larger loans like a home loan in the future.

Collateral: you typically do not need to pledge collateral to get approved. You lendiny minimize that cost by repaying the loan as quickly as possible — paying more than the minimum is a great way to save. Other fees apply if you pay late or pay by check. Any communication or questions about your loan will go through Lending Club. Lending Club is generally a safe and legitimate way to borrow, with industry-standard security in place. As always, how much money can you make from lending club sure you’re at the legitimate site before you provide sensitive information such as your Social Security Number.

Continue Reading.

My Lending Club Investment Review (what I did wrong 😭)

More from Entrepreneur

I was curious to see how the world of Peer-to-Peer Lending worked. This was different from investing in the stock market, because I became a mini-bank by lending microloans to people paying of credit card debt, home renovations, a new car, and multiple other reasons people take loans. All while I earn interest as they pay the loan off. When I started 2 years ago, I choose to individually select which micro-loans I wanted to invest in. I knew, like a traditional bank, some loans may default and you lose money. So I took the time to research each loan application and Lending Club gives you a detailed credit history to choose. I specifically looked at their credit history, what they want to use the loan for and history of delinquencies. As well as their debt to income ratio. This was a huge time waster. Here is how I have my Lending Club automated investing currently set up. Remember, I just turned on automated investing last week. For 2. Until then, good luck investing! A lot better than my 2 year experiment! You may want to stick to manual investing. I used automated and I attribute my low percentage to. The upside to this is you got something. Your email address will not be published. How Investing in Lending Club Went?

Comments

Post a Comment