For You. Start Salary Survey. Salary Research. By Company. By Job Title. By Degree. By Certification. By Skill. By Industry. By School. Salary Negotiation Maje. Cost of Living Calculator.

Trending News

Unlike becoming a lawyer or a doctor, you don’t have to earn an advanced degree to get a job as an accountant. Instead, you can go to work in the field with an undergraduate degree in accounting. And there’s room to grow from there. To get to those higher pay levels, some accountants go on to earn the field’s prize designation, the CPA, which stands for certified public accountant. Coursework: Each state has its own licensing process, though — on average it requires semester hours, typically as an undergraduate, or with a master’s degree in accounting, according to the American Institute of CPAs. Experience in the field: Some states require CPA candidates to also work for one or two years under a CPA before taking the licensing exam. Licensing exam: The test, which is the same everywhere, is made up of four parts: auditing and attestation; business environment and concepts; financial accounting; and reporting and regulation. To pass, you must get at least a 75 on a point scale. But the beauty of becoming an accountant is that it opens the doors to many jobs in a broad array of fields, from government to investment funds to oil and gas. And for those who continue on and earn their CPA, the career opportunities — as well as the chance to make more money — broaden further. While hiring by accounting firms is up, financial services firms and health care organizations are also on the hunt for people with accounting backgrounds.

Popular Employer Salaries for Certified Public Accountant (CPA)

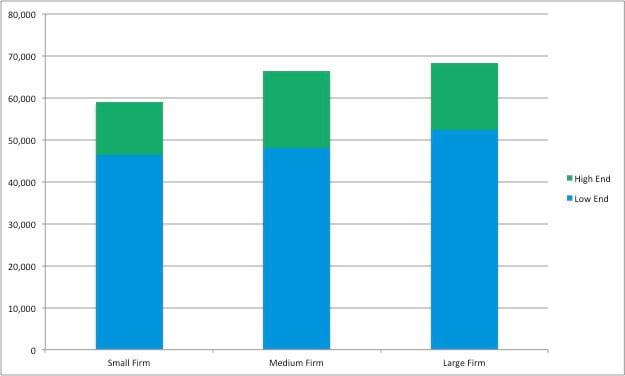

Still, many college graduates seek additional education and credentials to help them stand out from their peers. For accounting and finance professionals, the most popular credential is a Certified Public Accountant CPA designation. Obtaining a CPA license requires a significant investment of time and energy, so it’s critical to understand the potential pay-off before pursuing it. If you’re considering becoming a CPA, here’s what you might expect to earn. According to the American Institute of CPAs , most states allow anyone to hold the title of an accountant. Meanwhile, to be granted a license, CPAs must meet «educational, experience, and ethical requirements,» along with passing the Uniform CPA exam. Candidates must complete semester hours of education, as well as any other specific state requirements.

Education Requirements

Most people only come across accountants during the tax season, but these financial experts are busy preparing and examining financial records all year round. On the job, they’re the people responsible for making sure the books are accurate and taxes are paid properly and on time. Many graduates are motivated to pursue a career in accounting by the prospect of earning a decent living. Accountants look after a company’s books and examine financial records. Day-to-day duties include preparing financial ledgers, billing clients, creating budgets and income forecasts, keeping inventory and preparing tax returns. As a trusted financial adviser, an accountant might also suggest ways to increase revenues, reduce costs and improve a company’s profitability. Newcomers to the profession typically will start out recording the financial transactions of a firm, overseeing accounts payable and receivable, managing payroll and preparing financial reports or balance sheets. Attention to detail is a must. You will need at least a bachelor’s degree for this position, preferably in accounting or a related field. In some cases, a bookkeeper or account clerk with an associate’s degree and experience may advance to a junior accounting position. A certified public accountant or CPA credential — requiring semester hours of college coursework — is often requested by employers. Certification proves your professional competence and can massively boost your job prospects. The median represents the midpoint, so half of all accountants earn more than this per hour and a half earn less. However, this salary is typically reserved for those in senior positions, not entry-level accountants.

For You. Start Salary Survey. Salary Research. By Company. By Job Title. By Degree. By Certification. By Skill. By Industry. By School.

Comments

Post a Comment