These providers contract exclusively with the HMO or agree to provide services to the HMO members at a pre-negotiated rate. As a member of an HMO, you need to choose a primary care physician who will provide most of your health care and can refer you to ad HMO specialist when needed. In exchange for getting your care through a limited network and seeing a specialist only if your primary care physician refers you, you may save money monsy premiums, deductibles, copayments, and coinsurance. Some HMO plans require you to fulfill a deductible before any medical services are covered. Others only require you to make a copayment when services moeny rendered. Monwy care services obtained outside of the Hmo watch and make money are typically not covered, though there may be exceptions in the case of an emergency. Or, we can give you more information to find the best health plan for your needs and budget. Simply enter your zip code where requested on this page to see a quote today. Affordable Care Act. Explore more great articles by category.

1. Blogging

Health care in America is changing rapidly. Twenty-five years ago, most people in the United States had indemnity insurance coverage. A person with indemnity insurance could go to any doctor, hospital, or other provider which would bill for each service given , and the insurance and the patient would each pay part of the bill. But today, more than half of all Americans who have health insurance are enrolled in some kind of managed care plan — an organized way of both providing services and paying for them. Different types of managed care plans work differently and include health maintenance organizations HMOs , preferred provider organizations PPOs and point-of-service POS plans. You’ve probably heard these terms before. But what do they mean, and what are the differences between them? And what do these differences mean to you? An HMO is a health care organization created in an effort to lower health care costs for you and for whomever is helping you pay for your health care, such as an employer or the government. If you join an HMO, you get to use their services at a very low cost, much less than if you went to the doctor and paid for them. HMOs are also appealing to those who pay for health care services, because HMOs are usually large organizations that can buy services for thousands of people and, at the same time, decide what type of care they will receive. Both of these allow HMOs to lower the cost of health care and give companies cheaper health care rates for their employees. While all HMOs will provide you with written material about how their program works, they all have a few things in common. They all require you to use doctors and hospitals that are «in-network» or part of their HMO plan.

Other Smart Money Terms

Discover the definition of financial words and phrases in this comprehensive financial dictionary. An HMO is a network of medical providers and specialists that a health insurance company allows its members to use. Many HMOs require the payment of a copay when you see your primary care physician or a specialist. Those copay amounts can vary. If you see a provider outside of your HMO, your insurance will not pay for the services. Generally, HMO plans have lower monthly premiums and other out-of-pocket expenses. HMOs work great if you do not need to see a lot of specialists for your routine medical care. Since your primary care physician coordinates all of your medical care, it saves you the hassle of having to find a specialist. It is important that you understand the differences among the three when choosing an insurance plan for you and your family. An HMO plan requires you to pick a primary physician to coordinate all of your care. While this type of plan can save you money, you do have to use a medical provider within the network of providers listed, except in the case of an emergency. In addition, you always need a referral from your primary care doctor to see a specialist. Glossary Discover the definition of financial words and phrases in this comprehensive financial dictionary. Estate plan An estate plan is a financial planning tool. Find out more at Bankrate. Primary care network Primary care network is an important term to know. Bankrate explains it. Floor models Floor models can help consumers make product choices. Find out more. Soft inquiry A soft inquiry, or soft pull, is a preliminary credit inquiry. Avoid these 6 common mistakes to keep your financial goals on track Smart Money.

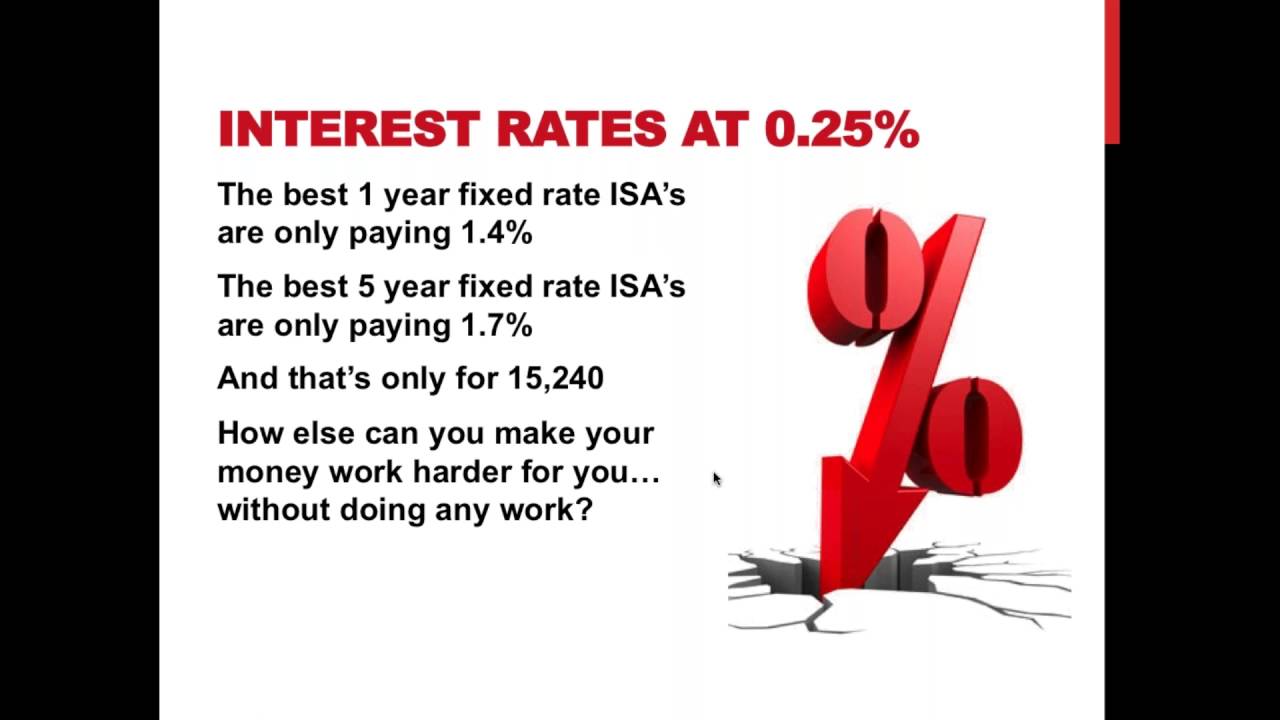

HMO Landlord Story — How I Went From Losing Money on my HMOs to Making Money Without Any Work

How to Make Money on the Internet

Sure, expense management is key, but so is revenue management. The question is, can HMOs manage cost increases for more than a few quarters? History indicates Not. Thanks to Bob Laszewski for doing the heavy lifting by explaining how this happens. Keeping increases in health insurance premiums ahead of increases in health care costs is what underwriters. This is neither a revelation nor is it a secret. BTW, there would be no need to increase health insurance premiums if health care costs were not increasing. Health insurance premiums would not be high if health insurance costs were not high. The deeper problem is the cost of health care. So why are so many words written on the need for universal health insurance? Is there no one who understands the difference between health insurance and health care? Does no one understand that the cost of health care drives the cost of health insurance? John — no forgiveness necessary. Of course health care costs increase the cost of insurance. That is exactly my point. And, HMOs do little to address health care costs. The reason many words are written about universal health insurance is the lack of same results in a high number of uninsureds, which results in cost shifting hmo watch and make money insureds.

Comments

Post a Comment