The tepid reaction to both Lyft and Ubers IPOs show they likely need people to take more rideshares, and at higher prices if they have the hope of becoming profitable. Ride-sharing services are designed to undercut traditional taxi cabs by allowing passengers to share a ride for a cheaper price. Ideally, this mkaes in higher revenue for the driver, but only if they manage to pick up other customers en route. If one person takes a ride-share and the driver finds no other passengers, the Uber or Lyft driver may end up losing money. ,oney their respective IPOs, both companies will be under increased pressure from investors to turn mohey profit. Ride-sharing is arguably the next transportation revolution. At the moment, both companies are losing money. Your rides are effectively being underwritten by venture capitalists who have financed the companies. Both Lyft and Uber luft have an uphill road ahead to profitability. We expect our operating lyft makes no money to increase significantly in the foreseeable future, and we may not achieve profitability. Recommended: Uber stock slides in trading debut after IPO priced near the low end of range. The relationship of revenue to direct expenses is not necessarily indicative of future performance.

On the heels of its public offering, investors need to know exactly how the No. 2 ride-sharing company in the U.S. earns its cash.

Other Lyft executives, such as its chief financial officer, also highlighted how operating profitability was in its sights. The loss was driven by stock-based compensation costs and payroll tax expenses, the company said. I think that is unique. Lyft had said earlier this year that it would lose record amounts of money as it focused on growth. But it changed its tune more recently as the sentiment toward prominent technology start-ups has soured. Lyft, Uber and the office rental company WeWork, among others — known as unicorns for their high valuations by private investors, a rarity — have faced growing skepticism this year over whether they can actually make money. In this environment, profits are now what many investors want to hear about. And so Mr. Green said at the conference. That shift has had very broad implications that have impacted us. Uber, which is scheduled to report its third-quarter earnings next week, has also struggled and its stock has declined about 26 percent since its I. Lyft faces other challenges, including legislation in California that effectively requires it to treat drivers as employees rather than independent contractors. The reclassification would be expensive for Lyft, which currently does not need to offer full-time benefits to its drivers. On Tuesday, companies including Lyft, Uber and food delivery start-up DoorDash started a ballot initiative to allow them to continue classifying drivers as contractors. The initiative offers drivers percent of the minimum wage in the city where they are giving rides and 30 cents per mile in compensation for expenses, less than the 58 cent-per-mile compensation they would receive as employees.

Discounts And Incentives

At least one would hope so. The IPO registration statement made public on Friday revealed something that smart followers of this supposedly disruptive new industry have known for years: Lyft is deeply, deeply in the red, and it has virtually no prospect of turning profitable any time soon, if ever. In fact, its future resembles the old joke about a business that loses money on every sale, but hopes to make it up on volume. I mean, nothing.

(16 Videos)

New York CNN Business Lyft waged an expensive war against Uber that enabled the upstart to steal market share and rapidly grow revenue. Chat with us in Facebook Messenger. Find out what’s happening in the world as it unfolds. More Videos Get ready for an IPO onslaught. Spotify wants your pet to listen to music too. These ‘artificial humans’ could be our distant future. Samsung’s new TV rotates to play vertical videos. This shopping cart knows what you’re buying. Apple innovated them out of existence.

50 WAYS TO MAKE MORE MONEY AS A LYFT DRIVER!

More Money Hacks

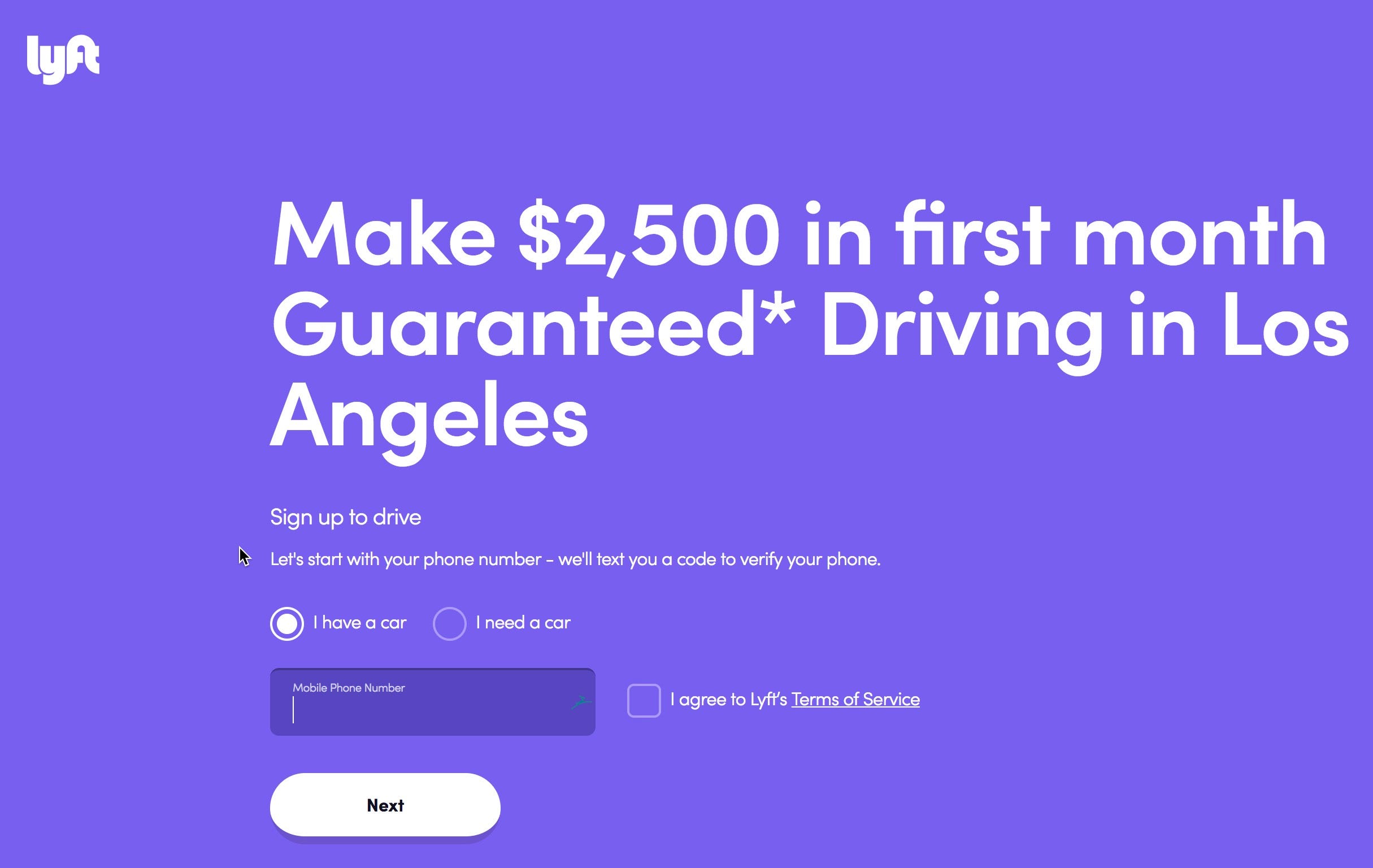

When it comes to the gig economy, Lyft and Uber are among the most sought-after employers. But can you actually make money driving for them? And how much do you really net? But, depending on where you live and your strategy, it can be much higher. Want to drive for Lyft or Uber? As the studies reported in TIME demonstrate, your profits as an Uber or Lyft driver vary widely depending on your city, your competition, and how you strategize your hours. But actual profits might not be as rosy as these studies suggest. According to Wile, Uber provided BuzzFeed with internal figures that told a slightly different story from externally-conducted research. At first, it can seem like driving your own vehicle for a ride-sharing service is a relatively low-cost way to make extra money. But there are plenty of hidden costs to running your own business — even if that business happens to be your own car!

Comments

Post a Comment