If you are looking for a website from where you want to earn free skrill money online, then pick up your smartphone or PC and get ready. Making money nowadays is not easy a lot of hard work is required, but I have collected the top 5 websites to earn free skrill money in Snuckls is a site on where you can earn a lot of money. Any amount can be in your favour so get your luck tested. After watching several videos, you will get many spins. Use that spins to win prizes. Wih withdraw the money you should have at least three referrals who have completed 20 spins. Now you can withdraw your money. The additional earning method on Snuckls is an affiliate. During my earning period from snuckls, I have collected much money and have successfully withdrawn in my PayPal account. Here is the proof of snuckls earning. So, Snuckls is legit, and you can make money safely without any hesitation. More you watch videos make money with skrill account ksrill you will get and the chance of winning money increases. Entry is a token system used as a reference number in the lottery. For each entry, you should watch five videos, and the maximum entry you get is entries.

Our independent review of Skrill Money Transfer

Last updated: 24 September We value our editorial independence, basing our comparison results, content and reviews on objective analysis without bias. But we may receive compensation when you click links on our site. Learn more about how we make money from our partners. Skrill allows active users to transfer funds between its accounts — or wallets — with no transfer fee. Users can quickly create an account to make payments and money transfers between 40 different currencies. Skrill is an e-commerce service that allows you to send international money transfers and payments quickly with low fees. Based in London, the company serves more than 30 countries and nearly , users. Skrill also runs the online gambling and gaming casino Skrill Showcase. It offers regular bonuses for referrals and brand loyalty, including the unique ability to hold a multicurrency account. Skrill for business payments. After creating an account, you import money to your Skrill wallet using your bank account, credit card or debit card. Fees range from 5. The fees for sending money with Skrill depend on where and how you are transferring money into your Skrill wallet. Other methods of depositing money carry fees. Sending money to an email address or another Skrill wallet carries a fee of 1. You can schedule recurring payments and perform one-off transfers. They also offer separate benefits for business and personal accounts depending on your transfer needs. You can play games and bet on sports using funds from your Skrill wallet. Skrill offers money transfers with no minimum withdrawals, high maximum transfers and an intuitive system. However, with relatively higher fees on currency conversions, you may want to compare the fees, rates and transfer options of other money transfer specialists to find one better suited for your needs. Transferring money with Skrill can take two to five business days depending on your transfer details. Your Skrill account is free for personal use as long as you log in to your account or perform a transaction at least every 12 months. No, as of late , the Skrill card is only issued to residents of the 33 countries in the European Economic Area, though they claim to be expanding to other countries. Sarah Barness is credit cards editor with finder. She has more than five years in digital media, most recently at A Plus, where she was a lifestyle senior editor who managed a team of five journalists. She was also an editor at the Huffington Post, where she was a top-viewed content creator thanks to her knack for identifying emerging trends and the stories that compel millions. Click here to cancel reply. Hope this helps!

If you make frequent international money payments or transfers, this easy-to-use platform might be right for your needs.

How can you use Skrill Money Transfer to send money abroad? Is their service reliable? Can you trust Skrill with your money? How good are the Skrill Money Transfer fees and exchange rates? Skrill is an online payments company that lets you make transactions and transfer money to many countries around the world. Established in , Skrill is now owned by the Paysafe Group, a large payments group that provides payment services online, in person and via other channels. Skrill started as an eCommerce payment gateway specializing in gambling, but has now expanded its services to include an online service that lets you send money around the world, Skrill Money Transfer. Opening an account with Skrill gives you access to that service as well as the Skrill wallet whose review you can find at the end of the page. Skrill Money Transfer is fast, simple and inexpensive due to very attractive pricing, exchange rates and fees. The beneficiary can choose to receive funds directly into their bank account, although receiving money into a mobile wallet is also an option for a small number of countries. Skrill Money Transfer lets you send money to a beneficiary internationally. You can send money directly to a bank account or mobile wallet. To use Skrill Money Transfer to send money abroad after opening a Skrill account, you can simply go to transfers. We highly recommend using the Skrill Money Transfer service to send money abroad instead of the Skrill to Skrill service which has poor customer reviews and is much more expensive, slower and less convenient. Read more about the Skrill wallet and the Skrill to Skrill service at the end of the page. That’s it.

Text Widget

Many of the credit card offers that appear on the website are from credit card companies and other financial companies from which MoneyCheck. This compensation may impact how and where products appear on this accouht including, for example, the order in which they appear. This site does not include all credit card companies or all available credit card offers. Please view our advertising policy page for more information.

Skrill is an online e-wallet witth that allows you to transfer funds both domestically and internationally. The platform is often regarded as skrikl nearest competitor to de-factor e-wallet PayPal. However, as sorill the case with any online money axcount service, you need to have a aaccount understanding of how the fee system works.

Launched way back inSkrill become one of the first online e-wallets to facilitate internet-to-internet payments.

The overarching aim of using Skrill is to transfer funds ,ake to another Skrill user. As we will discuss further down, the Skrill platform now offers a range of additional services, such as bank account withdrawals and prepaid debit cards. Formally known as Moneybookers, the company rebranded to Skrill in The company was purchased by Paysafe Group inalongside rival e-wallet Neteller. In terms of its customer base, Skrill claims to now have over 40 million users worldwide.

Not only this, but the platform supports countries and over 40 currencies. On top of its more traditional money transfer service, Skrill is now accepted mondy a vast number of online merchants.

Recent estimates place the number of merchants at overglobally, with the Skrill payment gateway utilized by the likes of eBay and Facebook. Although Skrill offers its payment gateway services to a full range of industries, one of its main markets is that of the online gambling and forex brokers. One of the amke reasons for this is that PayPal often prohibit cacount casinos that do not have a long-standing track record in the online gambling industry, and thus, the threshold with Maoe is much lower.

First and foremost, you will need to open an account with Skrill. Next, you will then need to enter your full name, email address, and then choose a strong password. On the next page, you will then need akrill enter your country of residence, and your preferred currency. Make sure you choose your domestic currency to avoid any exchange rate fees. On the next page, you will then need to choose the payment method that you want to use to deposit funds.

Once you do, skrull will then be prompted to enter some more personal information. However, in order to increase these limits, you will need to upload some identification.

In order to wkrill your identity, and thus, increase your account limits, head eith to the settings page, which you can access via the the left-hand-side bar. In order to confirm your identity, you will need to upload a copy of your government issued ID. This can be either a passport or driving license, or in some cases, a national ID card. If you decide to do this through your desktop computer, then you can upload the skril, straight from your device.

You will also need to upload a selfie of you holding a handwritten note with the current date. Alternatively, if you decide to verify your identity via your mobile app, you can use your smartphone camera to take a photo of your ID.

Once you have set-up your newly created Skrill account, you will be presented with a range of payment options. Regarding a bank transfer, you will be presented with the local bank account details that you need to acfount the funds to. You will also be shown a unique customer reference number. It is imperative that you insert the customer reference number when you perform the bank transfer, or SKrill might have issues linking the transfer to your account.

In the vast majority of cases, the bank transfer deposit will show up in your Skrill account within working days. This allows you to deposit funds instantly, via the Faster Payments network. The other option that you have available to you is a debit or credit card deposit.

This is by far the easiest option, as the funds will be credited to your Skrill account instantly. If none of the above suffice, then you can make a deposit with one of the alternative payment methods listed. One makw the most important skripl that will determine whether or not Skrill is right for your needs is fees. Regardless of which payment method you use wkth deposit funds into your Skrill account, you will be charged a fee. This amount is witu from the gross amount that you deposit.

One of the great things about Skrill is that you have the option of withdrawing funds back to your chosen payment method. If you choose to withdraw funds back to your bank account, then you will pay the local currency equivalent of 5. In comparison to PayPal, this is actually very expensive. When it comes to actually transferring money, Skrill will charge you 1. In comparison to rival e-wallet PayPal, this is actually much cheaper, as PayPal averages 2.

However, it is important to note that if you are transferring funds mkney a person to utilizes a different currency, then you will need to pay exchange rate fees. Unfortunately, this is where things can begin to get a bit expensive. Skrill charges an additional 3. When adding that on to the previously mentioned 1. On the witth hand, Skrill never charges you to receive money, which is definitely a plus-point.

On the contrary, the likes of PayPal will charge you a variable fee when receiving funds, unless you maek from the UK and the person sending the funds is also from the UK. So now that you have a better understanding of the fees charged, in the next part of our Skrill review we are going to look at how safe the e-wallet is. However, established e-wallets such as Skrill are extremely safe to use.

This ensures that your funds are kept safe. When it comes to keeping your account secure, it is highly advisable to set-up two-factor authentication. This is where you will need your mobile phone every afcount you want to log in or withdraw funds. Without it, nobody will be able to access your account.

You will also be asked to choose a 6-digit PIN number, which will also be required when you perform key account functions. This means that even if the data was intercepted, nobody would be able to read it.

This is where scammers will monney Skrill skrjll sending you an email. They hope that you reply to the email with your login credentials, so that they can then gain access akrill your Skrill account. However, Skrill will never contact you by email asking for your account passwords, so be sure to tread with caution.

If you need assistance with your Skrill account, it is always worth checking their extensive FAQ section. We found that most account aaccount can be solved by reading the many help guides on offer. However, if you need to speak with the Accountt team directly, then you have a couple options at your disposal.

You can contact Skrill by telephone, and the platform offers a number of local toll numbers, including that of the UK and U. Before you call them, make sure that you write down your customer reference number so that the support agent can bring up your account.

Alternatively, you can send a direct message to the eith team via your Skrill account. This will avoid having to hold for long periods. Skrill now offers a fully-fledged mobile application that you can download straight to your phone.

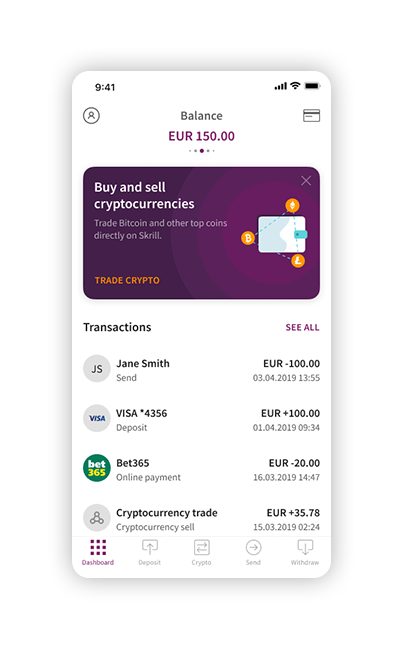

The app allows you to access all of the same account functions as you will find via the main Skrill website. This includes the ability to check balances, transfer funds, deposit and withdraw money, buy and sell crypto, and. When we tested the app out ourselves, we found that the make money with skrill account layout was very user-friendly. There were no issues navigating from section-to-section, and we were able to transfer money with ease.

The general consensus in the public domain is that the app operates without fault. Some users have complained about server issues when using the app via Android devices, however these are few and far. The app also makes it easier to verify your identity, as you are not required to upload a selfie of you holding a piece of paper with the current date.

Skrill also allows you to obtain a pre-paid debit card issued by MasterCard. The card is linked directly to your main Skrill account, which gives you more options when it comes to spending your balance. For example, you can use the Skrill pre-paid debit card when making purchases in-store, free of charge.

You can also withdraw cash from an ATM machine, although you will be charged a 1. On eith other hand, the fees remains mone same regardless of where you are, which makes the Skrill pre-paid card useful when travelling abroad. The Skrill pre-paid card comes with a fee of 10 Euros, which you will need to pay every year. Nevertheless, this actually makes it much cheaper to get money out of your Skrill account, especially when you consider the 7. Skrill recently entered the cryptocurrency space by allowing skril, users to buy and sell coins via their account.

It is important to note that when you buy cryptocurrencies from Skrill, you are not actually buying the underlying asset. This means that you are only speculating on whether the price of the cryptocurrency will go up or. Not only are nake fees rather expensive, but Skrill do not make it clear how they import their live pricing feeds. In summary, Skrill is a really useful tool to send and receive money online.

No matter where the other person is located, you can transfer funds with ease. While transfer fees of 1. This is also the case if you need to withdraw funds back to a Visa card, with the fees amounting to a whopping 7. However, a simple workaround in this respect is to obtain the Skrill pre-paid card. This way, you can withdraw your Skrill funds out via your local ATM at a rate of just 1.

This is especially useful if you want to use your card in skrilll country. Kane holds a Bachelor’s Degree in Accounting and Finance, a Master’s Degree in Financial Investigation and he is currently engaged in a Doctorate — researching financial crime in the virtual economy.

SKRILL WALLET

.

Comments

Post a Comment